Table Of Content

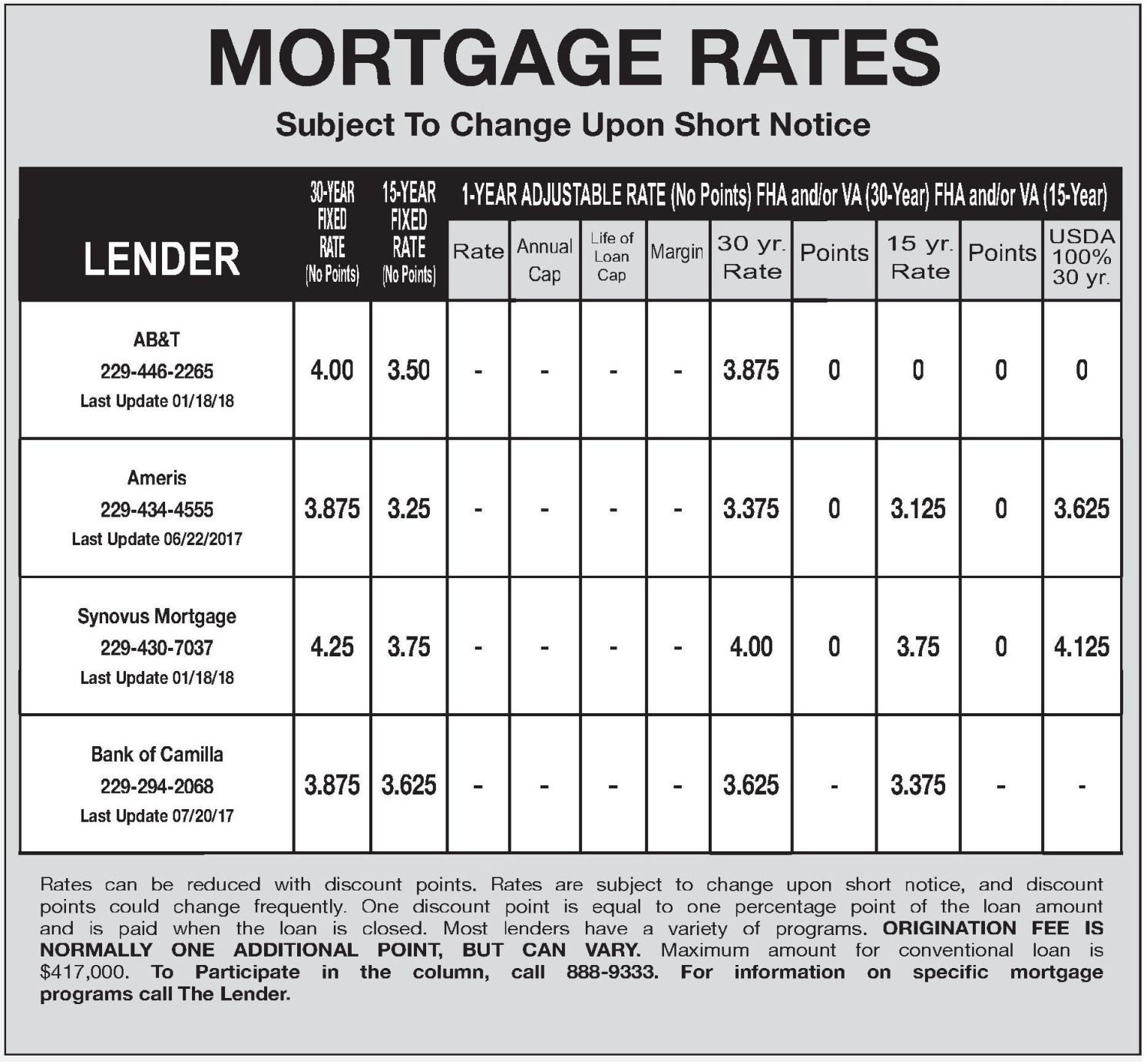

Check the county assessor’s website and local real estate listings to get an accurate idea of the property tax rates in the area where you’re buying. Nationwide, rates range from 0.30% to 2.13% of the home’s assessed value. Assessed value may be lower than market value, thanks to homestead exemptions. Once you can put down 20%, you won’t have to pay for mortgage insurance. Please visit our FHA Loan Calculator to get more in-depth information regarding FHA loans, or to calculate estimated monthly payments on FHA loans.

Home Affordability FAQs

This means your money is going toward your actual debt and not interest on that debt. It’s important to remember that if you don’t manage to pay down the debt before the 0% APR offer ends, you might end up with a higher interest rate on your debt than you had before. It’s important to remember that the mortgage lender is only telling you that you can buy a house, not that you should.

Using the 36% Rule

Buying A House With Friends - Bankrate.com

Buying A House With Friends.

Posted: Mon, 04 Mar 2024 08:00:00 GMT [source]

Input these numbers into our Home Affordability Calculator to get a clear idea of your homebuying budget. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

About Los Angeles, CA

In the mortgage process, it’s important to look at your budget, savings and assets for a couple of reasons. But if you can swing a balance transfer it might be able to help you fast-track your debt payment and get you to the debt-to-income ratio you need to qualify for a home purchase. If you are spending 40% or more of your pre-tax income on pre-existing obligations, a relatively minor shift in your income or expenses could wreak havoc on your budget. In order to avoid the scenario of buying a house you truly can’t afford, you’ll need to figure out a housing budget that makes sense for you. Results in no way indicate approval or financing of a mortgage loan. Contact a mortgage lender to understand your personalized financing options.

The 29/41 rule is important to know when thinking about your mortgage qualification because DTI helps lenders determine your ability to pay your mortgage. Although higher housing expenses and DTIs are allowed under many loan types (including conventional, FHA, USDA and VA loans), the 29/41 rule provides a good starting point. You need to calculate how much house you can afford while considering a wide range of loan options. When lenders evaluate your mortgage application, they calculate your debt-to-income ratio (DTI).

If you live in a town where transportation and utility costs are relatively low, for example, you may be able to carve out some extra room in your budget for housing costs. By using the 28 percent rule, your mortgage payments should add up to no more than 28 percent of $8,333, or $2,333 per month. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

What are the different types of home loans?

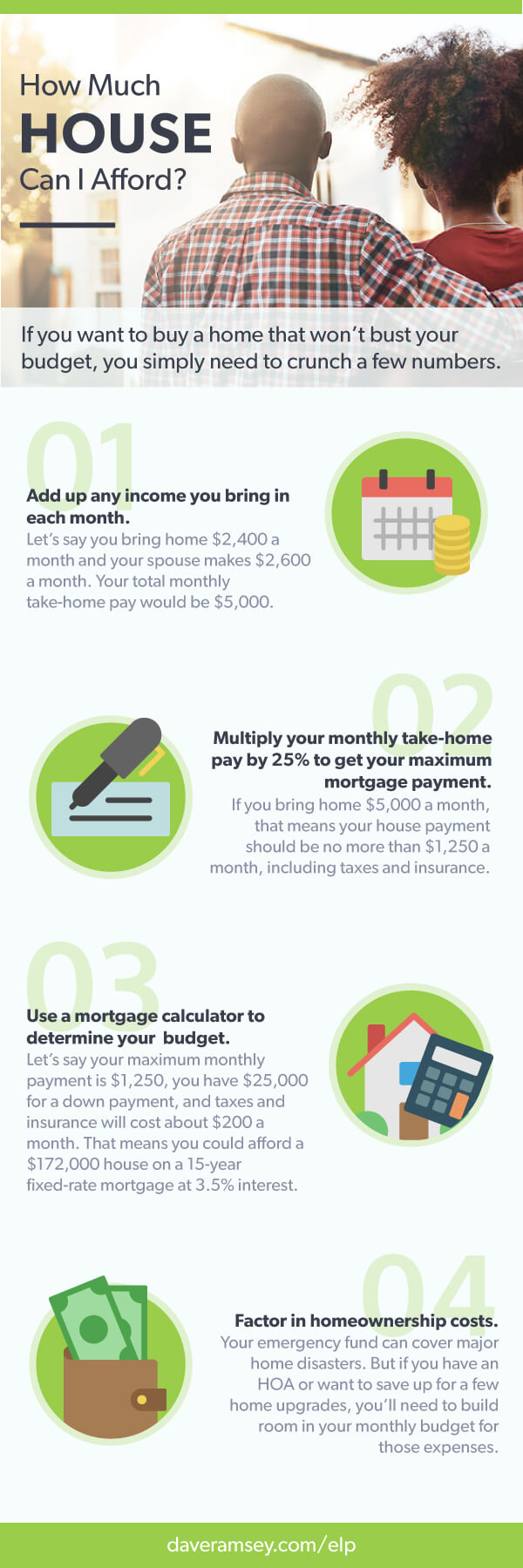

Check out this guide for the different methods for determining how much of your income should go to your mortgage. You may enter your own figures for property taxes, homeowners insurance and homeowners association fees, if you don’t wish to use NerdWallet’s estimates. In the U.S., conventional, FHA, and other mortgage lenders like to use two ratios, called the front-end and back-end ratios, to determine how much money they are willing to loan.

How much of my income should go towards paying a mortgage?

PMI costs are determined using a generic pricing sheet by Enact Mortgage Insurance. The industry often uses pricing more specific to a borrower’s situation, so your PMI costs could be higher or lower than shown here. Programs, rates, terms and conditions are subject to change without notice. Now that you have your estimated home price, check out different loan options with our Mortgage Calculator. While your lender is willing to loan you a substantial amount of money, that doesn’t mean you have to borrow the entire amount if it would put you under significant financial strain. The answer to that question depends on your financial status and your goals.

Homeowners Association Fees

Since interest rates vary over time, you may see different results. Find out how much you can afford with our mortgage affordability calculator. See estimated annual property taxes, homeowners insurance, and mortgage insurance premiums along with your estimated debt-to-income ratio.

Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. As a homeowner, you’ll pay property tax either twice a year or as part of your monthly home payment. This tax is a percentage of a home’s assessed value and varies by area. For example, a $500,000 home in San Francisco, taxed at a rate of 1.159%, translates to a payment of $5,795 annually.It’s important to consider taxes when deciding how much house you can afford. When you buy a home, you will typically have to pay some property tax back to the seller, as part of closing costs. Because property tax is calculated on the home’s assessed value, the amount typically can change drastically once a home is sold, depending on how much the value of the home has increased or decreased.

Eligible active duty or retired service members, or their spouses, might qualify for down payment–free mortgages from the U.S. These loans have competitive mortgage rates, and they don't require PMI, even if you put less than 20 percent down. Plus, there is no limit on the amount you can borrow if you’re a first-time homebuyer with full entitlement. You’ll need to also consider how the VA funding fee will add to the cost of your loan. Down payment & closing costsNerdWallet's ratings are determined by our editorial team. The scoring formula takes into account the type of card being reviewed (such as cash back, travel or balance transfer) and the card's rates, fees, rewards and other features.

No comments:

Post a Comment